How I Survived My Business Collapse — And Cut Taxes the Smart Way

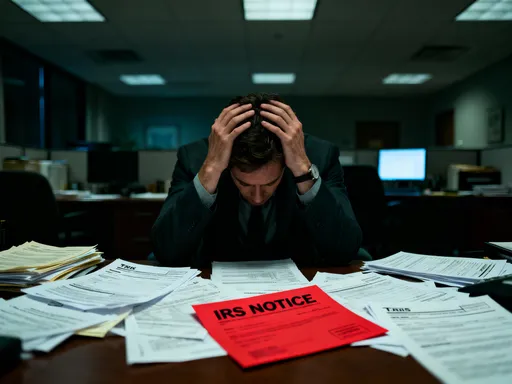

When my business crashed, I didn’t just lose income—I faced a tax nightmare. Penalties, unpaid liabilities, the works. But in that mess, I discovered smart, legal ways to reduce my tax burden and protect what little I had left. This isn’t theory. It’s what I lived, tested, and learned the hard way. If you’re struggling after a business failure, this could save you real money—and stress. The Internal Revenue Service doesn’t stop billing just because your customers did. I learned that the hard way, standing in my kitchen at 2 a.m., staring at a notice threatening a lien on my home. But from that fear came clarity. I began asking not just how to survive, but how to rebuild with smarter financial discipline. This is the path I took—one grounded in real experience, not textbook promises.

The Breaking Point: When the Business Failed and the Tax Bill Didn’t

It started with silence. No phone calls, no orders, no new clients. What had been a steady stream of income over five years dried up in less than six months. I had poured everything into the business—a home equity line, personal savings, even maxed-out credit cards. When revenue vanished, so did my ability to meet obligations. But while the business died quietly, the tax demands grew louder. Quarterly estimated payments were still due. Payroll taxes from the last employees I’d let go remained unpaid. And then came the notices—first by mail, then by phone. The IRS doesn’t wait for you to recover. They act fast, and they act hard.

One morning, I found my bank account frozen. No warning. No grace period. Just a message from my bank saying funds were seized under federal levy. That was the moment reality hit. This wasn’t just about losing a business. It was about losing control. The emotional toll was overwhelming. Shame, anxiety, sleepless nights. I felt like a failure—not just as an entrepreneur, but as a provider. But beneath the panic, a question emerged: Was there any legal way to reduce what I owed? Not to avoid responsibility, but to survive it? I didn’t want loopholes. I wanted relief that was honest, sustainable, and within the rules.

What I didn’t realize then was that I wasn’t alone. Thousands of small business owners face the same crisis every year. According to IRS data, over 600,000 federal tax liens are filed annually, many tied to failed businesses. The system isn’t designed to forgive, but it does allow for negotiation. The key was learning how to engage—not resist. I had to shift from feeling like a target to becoming a responsible taxpayer in distress. That mental shift was the first step toward regaining power. I stopped ignoring the letters. I started reading them. And I began to see that while the tax bill hadn’t disappeared, the way I responded to it could change everything.

Why Business Failure Triggers a Tax Emergency

Many people assume that when a business closes, its tax obligations end. That couldn’t be further from the truth. In fact, the opposite is often true—closing a business can trigger a cascade of tax consequences that are more severe than during operations. The IRS still expects final returns, payment of outstanding liabilities, and proper reporting of asset sales or employee terminations. Failure to file these documents on time leads to automatic penalties, even if no tax is ultimately owed. For sole proprietors and single-member LLCs, the line between personal and business tax responsibility is nearly invisible. That means unpaid business taxes can quickly become personal debt.

One of the most dangerous liabilities is unpaid payroll taxes. These include Social Security and Medicare withholdings from employee paychecks—money that was never actually yours, but held in trust for the government. The IRS treats failure to remit these funds as a serious offense. Under the Trust Fund Recovery Penalty, the IRS can hold business owners personally liable for 100% of the unpaid amount. This isn’t just a business debt—it can follow you for life. I didn’t understand this when I let payroll tax payments slide during the downturn. I thought I was borrowing from the government, planning to pay back later. But the IRS saw it as theft of public funds. That distinction made all the difference.

Another hidden trap is the requirement for estimated quarterly taxes. Even if your income drops, the IRS expects payments based on prior-year liability or current-year projections. When business revenue collapses, those payments become impossible, leading to underpayment penalties. These compound quickly, especially if returns go unfiled. The longer you wait, the more interest accrues—currently at rates over 8% annually. On top of that, failure-to-file and failure-to-pay penalties can add up to 47.5% of the original tax debt. It’s a snowball effect: one missed step leads to escalating costs, collection actions, and personal financial ruin. The system punishes silence. But it rewards engagement. That’s why understanding the mechanics of tax liability after failure isn’t just helpful—it’s essential for survival.

The First Move: Stopping the Bleeding with Immediate Relief Strategies

When the notices pile up and the bank account is frozen, the first goal isn’t to pay everything. It’s to stop the damage. The IRS has enforcement tools, but it also has relief programs. The key is to act quickly and communicate. One of the most effective steps I took was requesting an installment agreement. This allows taxpayers to pay off debt over time, typically up to 72 months, with reduced penalties. While interest still applies, it prevents further collection actions like levies or liens. I applied online through the IRS website, providing basic financial information. Within weeks, the calls stopped, and my account was marked “currently not collectible” during review.

Another critical move was applying for penalty abatement. The IRS offers this relief under the “reasonable cause” provision. If you can show that circumstances beyond your control—like business failure, illness, or natural disaster—prevented compliance, they may remove penalties. I submitted a written statement explaining the sudden drop in revenue, supported by bank statements and closure documents. After several months, I received a letter confirming that over $8,000 in penalties had been waived. It wasn’t forgiveness of the principal, but it significantly reduced the burden. This taught me that the IRS isn’t always the enemy. They’re a bureaucracy with rules—and those rules include compassion for hardship.

For those with overwhelming debt, an Offer in Compromise (OIC) may be an option. This program allows taxpayers to settle for less than the full amount owed, based on their ability to pay. Approval isn’t guaranteed—only about 40% of applications succeed—but it’s worth exploring for those truly unable to meet obligations. I consulted a tax professional before applying, which increased my chances. The process required detailed financial disclosure, including assets, income, and monthly expenses. While my OIC was initially denied, the review process led to a revised payment plan that was far more manageable. The lesson? Do not wait. The longer you ignore the problem, the fewer options remain. Calling the IRS, even when you’re afraid, is the first act of financial recovery.

Restructuring Debts: Separating Personal and Business Liabilities

One of the biggest mistakes I made was mixing personal and business finances. I used my personal credit card for office supplies. I paid business bills from my checking account. I even took cash advances to cover payroll. At the time, it seemed practical. In hindsight, it was financial suicide. When the business failed, the IRS saw no distinction. Every dollar spent became part of the audit trail. And because I operated as a sole proprietor, there was no legal separation. My house, my car, my savings—all were at risk.

After the collapse, I worked with a tax attorney to understand how to protect myself moving forward. One option was to form a formal business entity—like an S-corporation or limited liability company—after the fact. While this doesn’t erase past liability, it can help in bankruptcy proceedings or future planning. More importantly, I learned how to file final returns correctly. This includes Form 966 for dissolving a corporation, Form 1040 Schedule C for sole proprietors, and Form 941 for final payroll reporting. Filing these properly signals to the IRS that you’re closing responsibly, not fleeing.

In some cases, bankruptcy may be necessary. Chapter 7 can discharge certain tax debts if they meet specific criteria—such as being at least three years old and properly filed. Chapter 13 allows for reorganization through a court-approved repayment plan. I avoided bankruptcy, but only because my debt was manageable under an installment agreement. For others, it may be the only path to relief. The key takeaway is this: do not rely solely on an accountant. A tax attorney brings legal protection and deeper knowledge of liability issues. They can negotiate with the IRS, represent you in appeals, and help shield personal assets. Financial recovery starts with legal clarity, not just numbers on a spreadsheet.

Tax Optimization After Failure: Deductions, Losses, and Carrybacks

Here’s a truth many don’t know: business failure can lead to tax savings—if handled correctly. When a business closes at a loss, that loss can offset other income. The IRS allows net operating losses (NOLs) to be carried back or forward to reduce taxable income in other years. Before 2021, NOLs could be carried back two years, resulting in immediate refunds. While current rules limit carrybacks, exceptions exist—especially for businesses affected by disasters or economic downturns. I was able to apply my 2020 NOL to 2018 and 2019, receiving a refund that helped cover living expenses during recovery.

There are also specific deductions available during business shutdown. These include costs related to severance payments, contract cancellations, legal fees, and even the sale of equipment at a loss. I sold my office furniture and computers for a fraction of their value. While painful, that loss became a deductible expense. I also wrote off unpaid invoices as bad debt, provided I had previously reported the income. Every dollar counted. The goal wasn’t to profit from failure, but to minimize the damage through legal write-offs.

Timing matters. Final business expenses—like paying off a lease or settling a vendor contract—should be made before year-end to qualify for that tax year’s return. I delayed a few payments into January, only to realize they couldn’t be deducted until the next filing. A small mistake, but one that cost me over $2,000 in lost deductions. Working with a tax advisor helped me maximize every eligible expense. The message is clear: shutdown costs are not just losses—they are opportunities for tax relief, if documented and timed correctly. This isn’t about gaming the system. It’s about using the rules as they’re intended—to support taxpayers through hardship.

Avoiding Future Traps: Systems That Protect You Next Time

Survival is only half the battle. The other half is prevention. Now, I run my new business with systems designed to withstand failure. The first rule: separate accounts. I have dedicated business checking, savings, and credit accounts. No more mixing. This creates a clear paper trail and protects personal assets. The second rule: tax reserves. Even in profitable months, I set aside 25–30% of income for taxes. This sits in a high-yield savings account, untouched until payment time. It’s like an emergency fund for the IRS.

I also conduct quarterly tax reviews. Every three months, I meet with my accountant to project income, estimate liabilities, and adjust withholdings. This prevents surprises. I use accounting software that flags overdue invoices, tracks deductible expenses, and generates reports automatically. Tools like IRS Direct Pay and EFTPS make electronic payments easy and documented. But the most powerful habit I’ve adopted is the “pre-mortem” review. Before launching any new venture, I ask: What if this fails? How will I handle the taxes? Thinking about collapse before it happens changes how you manage risk.

Another safeguard is ongoing education. I attend free IRS webinars, read publications from the Small Business Administration, and stay updated on tax law changes. Knowledge is the best defense against panic. I’ve also built a support network—other business owners who’ve been through failure. We share strategies, recommend professionals, and remind each other that setbacks don’t define success. These systems don’t guarantee immunity, but they build resilience. They turn financial chaos into controlled, manageable processes.

Mindset and Recovery: Rebuilding Finances Without Fear

Healing from business failure isn’t just financial—it’s emotional. For months, I carried shame. I avoided friends who ran successful companies. I lied to my family about why money was tight. But the truth is, most small businesses fail. The U.S. Bureau of Labor Statistics reports that about half don’t survive past five years. Failure isn’t rare. It’s part of the journey. What matters is how you respond. I had to forgive myself. I had to accept that I made mistakes, but I didn’t act with intent to harm or deceive.

Smart tax decisions aren’t about hiding money. They’re about fairness, responsibility, and survival. When I finally faced my debt, filed my returns, and engaged with the IRS, I regained control. I stopped feeling like a victim and started acting like a steward of my future. Today, I run a smaller, more sustainable business. I pay taxes on time. I keep reserves. And I sleep through the night. The trauma of failure hasn’t vanished, but it’s been transformed into wisdom.

Rebuilding isn’t about returning to what was. It’s about creating something better—more careful, more informed, more resilient. You don’t have to be perfect. You just have to be persistent. The tax system is complex, but it’s not heartless. It allows for second chances—if you’re willing to face the facts, take responsibility, and use the tools available. I did. And if I can come back, so can you. The path isn’t easy, but it is possible. With the right knowledge, the right support, and the courage to act, you can survive the collapse—and emerge with more than just your finances intact.